Overview

The Connecticut Sales Tax Report is designed to provide the specific figures you will need to file your sales tax in the state of Connecticut. This report differs from the Sales Tax Report in that it provides separate totals for items that only were taxed at the regular rate versus items that were taxed at the luxury rate. It also provides separate totals for sales tax collected and sales tax returned.

This report will only work if you have correctly set up your tax definitions. To learn more about CT Tax Definitions, click here.

This report will only work if you have correctly set up your tax definitions. To learn more about CT Tax Definitions, click here.

Running the Report

To run the CT Sales Tax Report:

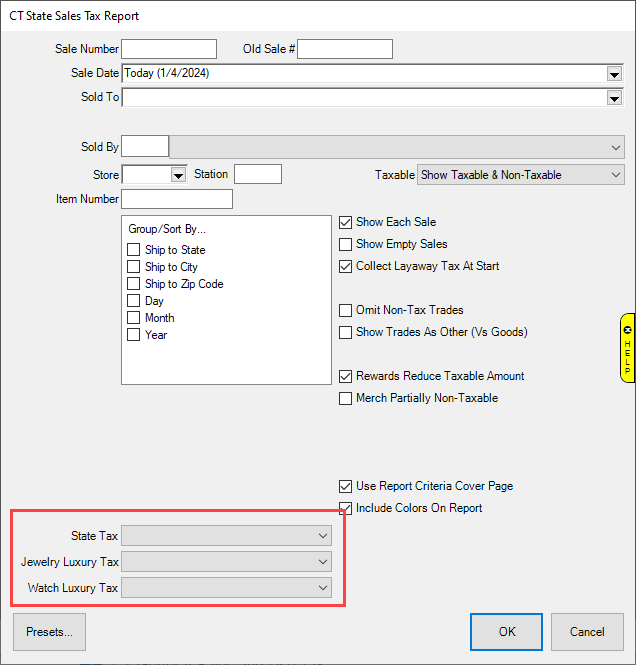

- Click Reports > Activity > CT Sales Tax. The CT Sales Tax Report window will open.

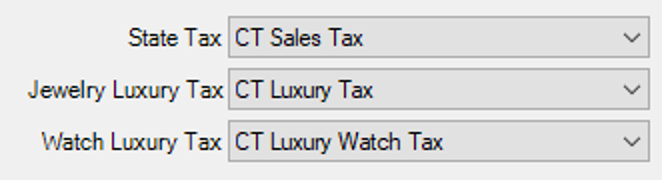

- Use the drop-down menus located at the bottom left of the window to select your tax definitions:

- You should have all three configured and set to the applicable tax definition. Please note that these are user-defined, your definitions may be named differently.

NOTE: We recommend that once you set this saving as your default Preset (Presets… > Set as Default) so that they will be remembered in the future.

- Set other options as desired and click OK to generate the report.

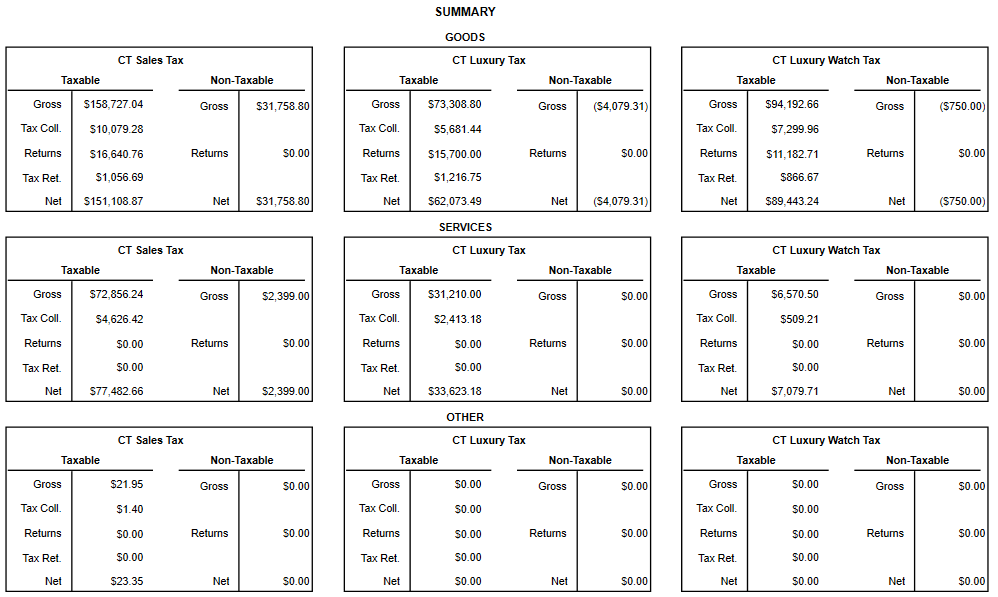

- Each tax will have separate groupings for tax collected versus returned.

- The final page of this report includes a summary providing totals for Goods, Services, and Other broken down by Sales Tax, Luxury Tax, and Luxury Apparel (Watch) Tax.

Important Notes

Below you will find important information to consider when running the CT Sales Tax Report.

- At this time when filing your taxes, the state does not separate jewelry luxury tax versus apparel luxury tax, so you will need to combine these numbers.

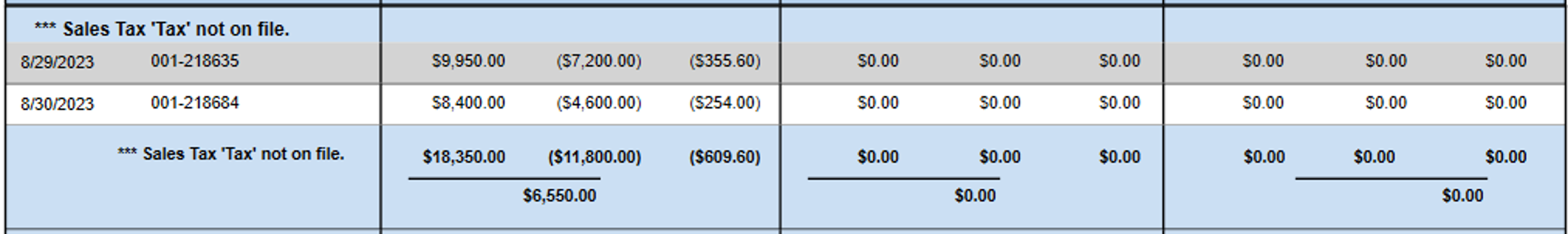

- If you are a converted customer, you will need to manually account for converted returns. These will appear on the first page of the report under the grouping ***Sales Tax ‘Tax’ not on file as shown in the example image below:

- The Edge has special rules for processing sales that include Trades and Custom Jobs: https://edgeuser.com/Pages/CTTrade. If you do not follow these rules the report may be inaccurate.