Below you will find important information to consider when running the CT Sales Tax Report.

Important Notes

- At this time when filing your taxes, the state does not separate jewelry luxury tax versus apparel luxury tax, so you will need to combine these numbers.

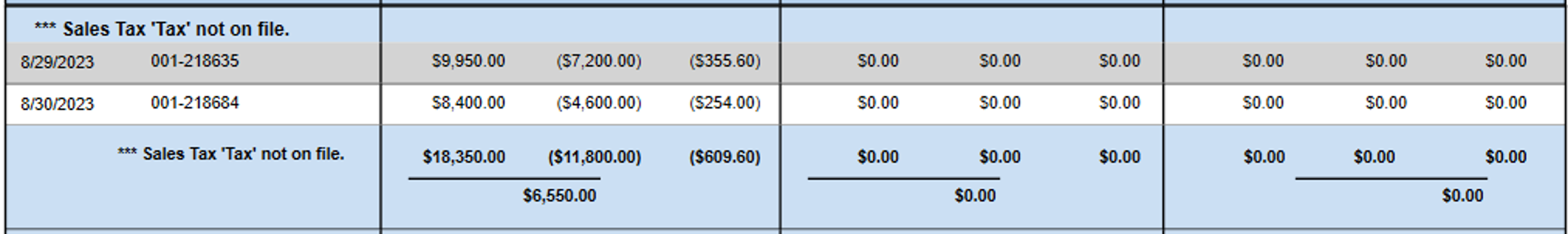

- If you are a converted customer, you will need to manually account for converted returns. These will appear on the first page of the report under the grouping ***Sales Tax ‘Tax’ not on file as shown in the example image below:

- The Edge has special rules for processing sales that include Trades and Custom Jobs: https://edgeuser.com/Pages/CTTrade. If you do not follow these rules the report may be inaccurate.