When a memo item is sold, the cost of that item is moved from the Memo Goods Liability account to this Memo Payable Liability account, indicating that the vendor can now be paid. Be sure to use a QuickBooks liability account for this purpose. A balance in this account indicates a memo item has been sold and that a vendor may be paid.

Procedure

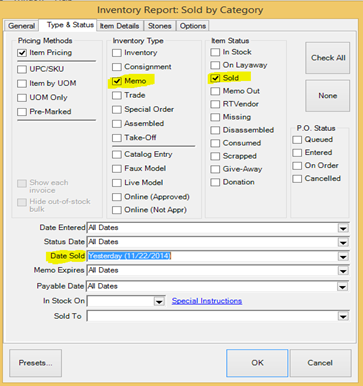

- To identify memo items sold, go to Reports > Inventory > Sold > By Category.

a. In the Type & Status tab, select Memo, Sold.

b. Enter the date.

c. Select OK.

- To enter the vendor bill in QuickBooks, go to QuickBooks, go to Vendors > Enter Bills and enter the bill. Be sure to offset the Memo Payments Due account to reduce the balance accordingly.

NOTE: When a memo item is sold, the item record gets updated with a payable date to reflect that The Edge has posted to Memo Payments Due.

NOTE: If a sold memo item is returned to stock, it is assumed the item is now owned merchandise. A supervisory function is available to remove the payable if appropriate. If you remove the payable, The Edge will post to QuickBooks removing the item as an owned stock item and then post adding it as memo.

To help identify such items, do an Items > Find and check the option for memo and in-stock, with Payable Date of ANY.