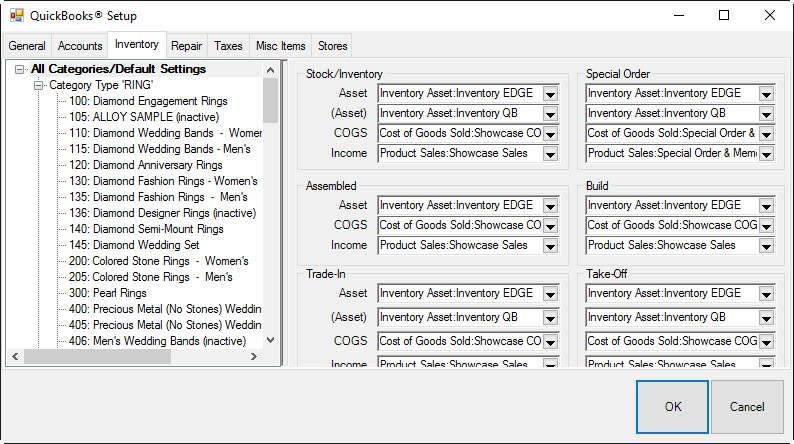

QuickBooks Inventory Tab

The Inventory tab allows you to specify how inventory-related transactions are posted to QuickBooks. This tab consists of a tree view on the left side and four groups of account drop-down fields on the right side.

To indicate how transactions are posted to QuickBooks:

- Select the desired line from the tree view on the left side.

- Complete the drop-down fields on the right side.

NOTE: The first line in the tree view, “All Categories/Default Settings,” applies to every piece of inventory in the system. Point of fact, only this line must be selected and filled in. All other lines in the tree view are for specifying exceptions to the default settings.

The panel on the right allows you to specify the QuickBooks accounts where The Edge will post based on the Inventory Stock Type.

For example, you can specify a different Income account for Memo Goods so this income can be tracked separate of owned stock. This is very flexible. You should discuss the level of separation is needed with your accountant.

NOTE: An information field will appear at the very bottom of the screen that details how The Edge uses the selected account.

The drop-down groups are defined as follows:

|

The “Stock/Inventory” Group

|

|

Asset

|

When a “stock” inventory item is added to inventory, the cost of that item is debited to this G/L account to increase the asset. When a “stock” item is sold or picked up, this account is credited to decrease the asset.

|

|

*(Asset)

|

*This is a contra-asset account that must be maintained by you. When a “stock” inventory item is added to inventory, the cost of that item is credited from this G/L account.

When the bookkeeper enters a bill in QuickBooks, the total inventory amount entered in The Edge should be posted to this account. If all inventory items are accurately entered into The Edge and all bills are accurately entered into QuickBooks, this account should be 0.

|

|

COGS

|

COGS stands for “Cost of Goods Sold.” When a “regular” inventory item is sold, the cost of that item is moved from the “Asset” account to this “COGS” account.

|

|

Income

|

When a “regular” inventory item is sold, the sale price of that item is posted to this “income” account. The reverse amount is posted to “Accounts Receivable.” Any tender taken on the sale is in turn used to offset accounts receivable.

|

The “Special Order” Group

The fields in this group have exactly the same meaning as in the “Stock/Inventory” group, except that they are used with respect to items of the inventory type “Special Order.”

The “Assembled” Group

The fields in this group have exactly the same meaning as in the “Stock/Inventory” group, except that, since this inventory is assembled from other items, there is no need for the contra-asset account. The cost of these items will flow in and out of the asset account mapped to the feature Inventory Assembly/Disassembly (see the Accounts tab).

The “Take-Off” Group

The fields in this group have exactly the same meaning as in the “Stock/Inventory” group, except that, since this inventory represents pieces taken off of other inventory items, there is no need for the contra-asset account. The cost of these items will flow in and out of the asset account mapped to the feature Inventory Assembly/Disassembly (see the Accounts tab).

The “Trade-In” Group

The fields in this group have exactly the same meaning as in the “Stock/Inventory” group, except that they are used with respect to items of the inventory type “Trade-In.”

The “Memo Goods” Group

|

Field Name

|

Description

|

|

Asset

|

When a “memo” item is added to inventory, the cost of that item is debited to this G/L account to increase the asset. When a “memo” item is sold or picked up, this account is credited to decrease the asset.

|

|

Liability

|

When a “memo” item is added to inventory, the cost of that item is credited from this G/L account. This allows QuickBooks to keep track of goods in the store that are owned by a third party.

|

|

COGS

|

COGS stands for “Cost of Goods Sold.” When a “memo” item is sold, the cost of that item is moved from the “asset” account to this “COGS” account.

|

|

Income

|

When a “memo” item is sold, the sale price of that item is posted to this “income” account. The reverse amount is posted to “Accounts Receivable.” Any tender taken on the sale is in turn used to offset accounts receivable.

|

|

*Payable

|

When a “memo” item is sold, the cost of that item is moved from the “liability” account to this “Payable” account, indicating that the vendor can now be paid.

Be sure to use a QuickBooks liability account for this purpose. An accounts payable account will not work properly.

|

The “Consignment Goods” Group

The fields in this group have exactly the same meaning as in the “Memo Goods,” except that they are used with respect to items on consignment from a customer.

Consignment items are liability items owned by customers and therefore “payable” can be applied differently than memo items, which are owned by a vendor.

There is a System Option in The Edge where payment for a sold consignment item can be posted as a credit memo on account for the customer at the time the consignment item is sold. If this option is set to True, the payable will post to QuickBooks as to the Credit Memo account instead of a Consignment Payable account.

NOTE: When a memo or consignment item is sold, the item record gets updated with a payable date to reflect that The Edge has posted to Memo or Consignment Payments Due.

If a sold memo or consignment item is returned to stock, it is assumed the item is now “owned” merchandise. A supervisory function is available to remove the payable if appropriate.

An In Stock Memo or Consignment with a Payable Date is no longer a liability.